Increasingly clear a 'hard Brexit is on the cards'

Markets are reacting to strengthening signals that the UK is to leave the single market in its EU divorce, Ian King writes.

Monday 16 January 2017 14:45, UK

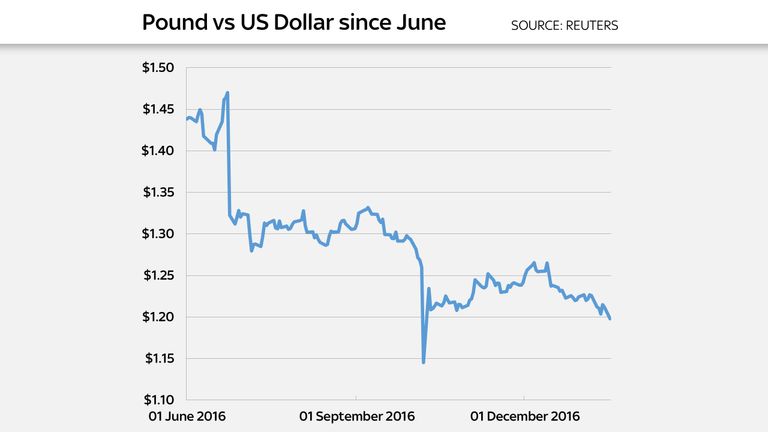

Every public utterance made by Theresa May on the likely shape of Brexit 鈥� her speech at the Conservative Party Conference in October and her interview with Sky鈥檚 Sophy Ridge earlier this month being good examples 鈥� has sent the pound lower on foreign exchange markets.

Looking at , ahead of Mrs May’s keynote speech tomorrow on Brexit, it is tempting to suggest that traders have decided to cut out the middle(wo)man and sell the pound just to be on the safe side.

All of the indications in the weekend press were that the Prime Minister is leaning towards a so-called ‘hard Brexit’, involving not only leaving the EU’s single market but also the customs union, which – rightly or wrongly – is seen as having dire consequences for the UK economy if there is not some kind of transitional deal in place.

Accordingly, sterling has fallen to its lowest level for three months against the US dollar and is also trading lower against the euro and other major currencies - notably the Japanese yen, against which the pound fell by some 2% in overnight trading in Asia.

The fall against the dollar was particularly marked. Having traded at around £1 to $1.2175 in the United States on Friday evening, it fell to as low as $1.1983 in early trading in Asia, a sharp fall by the standards of the currency markets.

Apart from the still unexplained ‘flash crash’ on 7 October, that was the lowest the pound had traded against the greenback in 32 years.

It has since rallied somewhat, one explanation for which is that US President-elect Donald Trump’s interview in The Times, in which he promises Britain following Brexit, has helped put a ‘floor’ under the pound, at least for now.

What is becoming increasingly clear is that a ‘hard Brexit’, even though Mrs May dislikes the term, is on the cards.

A number of businesses have now reconciled themselves to that, as shown by the change in stance last week from TheCityUK, the main lobbying body for the UK’s financial services industry.

It has now abandoned hope that the sector would be able to retain passporting rights – the ability to sell its services anywhere in the single market without having to deal with national financial regulators – a right that it had previously hoped to keep.

Accordingly, rather than debating whether the UK will undergo a ‘soft’ or a ‘hard’ Brexit, investors are instead having to assess the speed at which a ‘hard’ Brexit will be implemented and the ‘hardness’ of that Brexit: whether or not, for example, there will be a transitional deal with Brussels of the kind that Sir Ivan Rogers, the former UK Ambassador to the EU, had wanted.

Adding to this sense of a hard Brexit have been the remarks by Chancellor Philip Hammond in an interview with German newspaper Die Welt am Sonntag, during which he appeared to indicate that should Britain not receive the kind of trade deal from the EU that it would like, it could respond by setting itself up as some kind of Singapore-style tax haven.

That suggests senior Government figures are indeed contemplating the kind of scenario that commentators would describe as a hard Brexit.

Opinions vary as to how far sterling could yet fall. Some argue that the stance Mrs May is likely to take in her speech on Tuesday is unlikely to be markedly different from the comments she has already made publicly and that, accordingly, there is no reason why sterling should trade markedly lower than it is currently doing in the absence of evidence that the economy is weakening.

Others argue that, if the UK genuinely does end up with a hard Brexit and no transitional deal with the EU, it is likely to come as a shock to the UK economy that could see sterling trade as low as $1.10.

Perhaps the bigger question is where sterling will trade against the euro in coming weeks and months.

There is growing evidence suggesting that the eurozone economy is, at long last, staging following years of stagnation.

The European Central Bank has already said it will halt its programme of asset purchases at the end of 2017.

If the single currency zone’s economy continues to strengthen markedly, prompting the ECB to muse publicly on the prospect of raising interest rates, the really interesting action could be in how sterling trades not against the dollar, but the euro.