Theresa May's words on bosses' pay after Carillion might not become reality

The PM's other plans to tackle corporate excess are yet to come into effect, leading to doubts about her latest promise.

Monday 22 January 2018 09:32, UK

Carillion's collapse, and its huge pension deficit, have provided an opportunity for Theresa May to revitalise her much-touted crackdown on corporate greed.

The latest announcement is a plan to make company directors "explain themselves" if they are seen to have "lined their own pockets by putting their workers' pensions at risk".

A white paper, due to be published in the spring, is expected to set out Government plans to give the pensions regulator new powers, which could include the ability to issue significant fines to bosses in cases of clear wrongdoing.

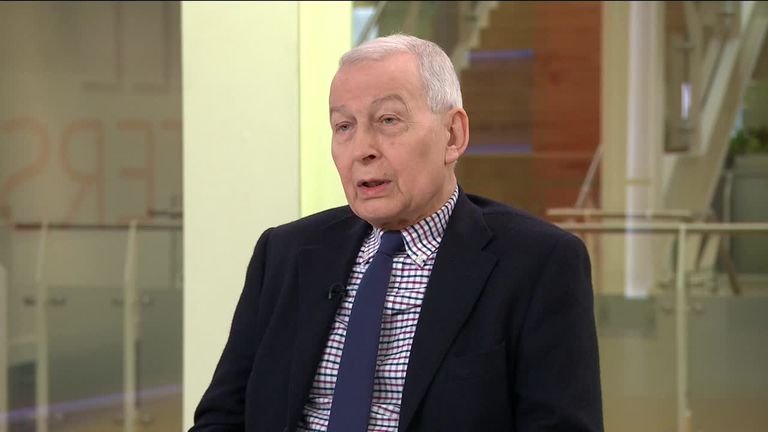

It has been welcomed by Labour's Frank Field, who chairs the House of Commons' Work and Pensions Select Committee, a group of MPs who have recommended such powers in the past.

Mr Field told Sky News such a move would "strike the fear of God" into executives.

But there are already mutterings in Westminster that Sunday's headlines may not turn into reality.

In a tweet, Labour peer Andrew Adonis, who recently resigned from the Government's National Infrastructure Commission, cast doubt on Mrs May's latest vow.

He wrote: "4th time since becoming PM that Mrs May has pledged action against corporate fat cats and rogues.

"Always dropped the day after the headlines. Just a pretense!"

The Prime Minister, in her op-ed article in The Observer, did not explicitly spell out the idea of giving fining powers to the regulator.

This suggests she is all too aware of how tricky pushing through such a plan could be politically.

A number of other policies have been put forward as part of Mrs May's agenda for tackling corporate excess, but not all have come into effect.

A plan to force all listed companies to publish pay ratios between bosses and employees will be in force next year.

But other ideas, such as having employee representation on company boards, or giving shareholders binding annual votes on executive pay, have been shelved.